The fastest, most accurate

automated file forensics platform

AI-based advanced fraud detection

Image verification

Document integrity

Automated forensics

FDS proactively and accurately uncovers fraud at the file level so you can focus on paying legitimate claims and underwriting new business.

FDS detects fraud on most file types, in seconds, using over 175 detections points

The FDS Detection Engine

FDS is evidence-based and will reveal if a digital document, pdf, photo or video has been changed, altered or updated. FDS enables insurers to screen claims and uncover fraud, even on claims that are below a certain threshold, that become too costly to investigate using a manual claims process.

It can take a trained forensics expert up to an hour, per submitted attachment, to detect potential fraud. FDS does this in seconds for every file you receive.

FDS can improve your combined ratio

Improved fraud detection rate

Screening and detecting fraudulent claims and reducing pay-outs on these claims.

Improved operational costs

FDS automation improves claims handling and ensures that resources are only spent on evidence-based fraud and not wasted on legitimate claims.

Enhanced customer value and loyalty

Integrate FDS into your straight-through process or connect FDS to your incoming claims mailbox to enable real-time detection and improve customer satisfaction with faster claim payments.

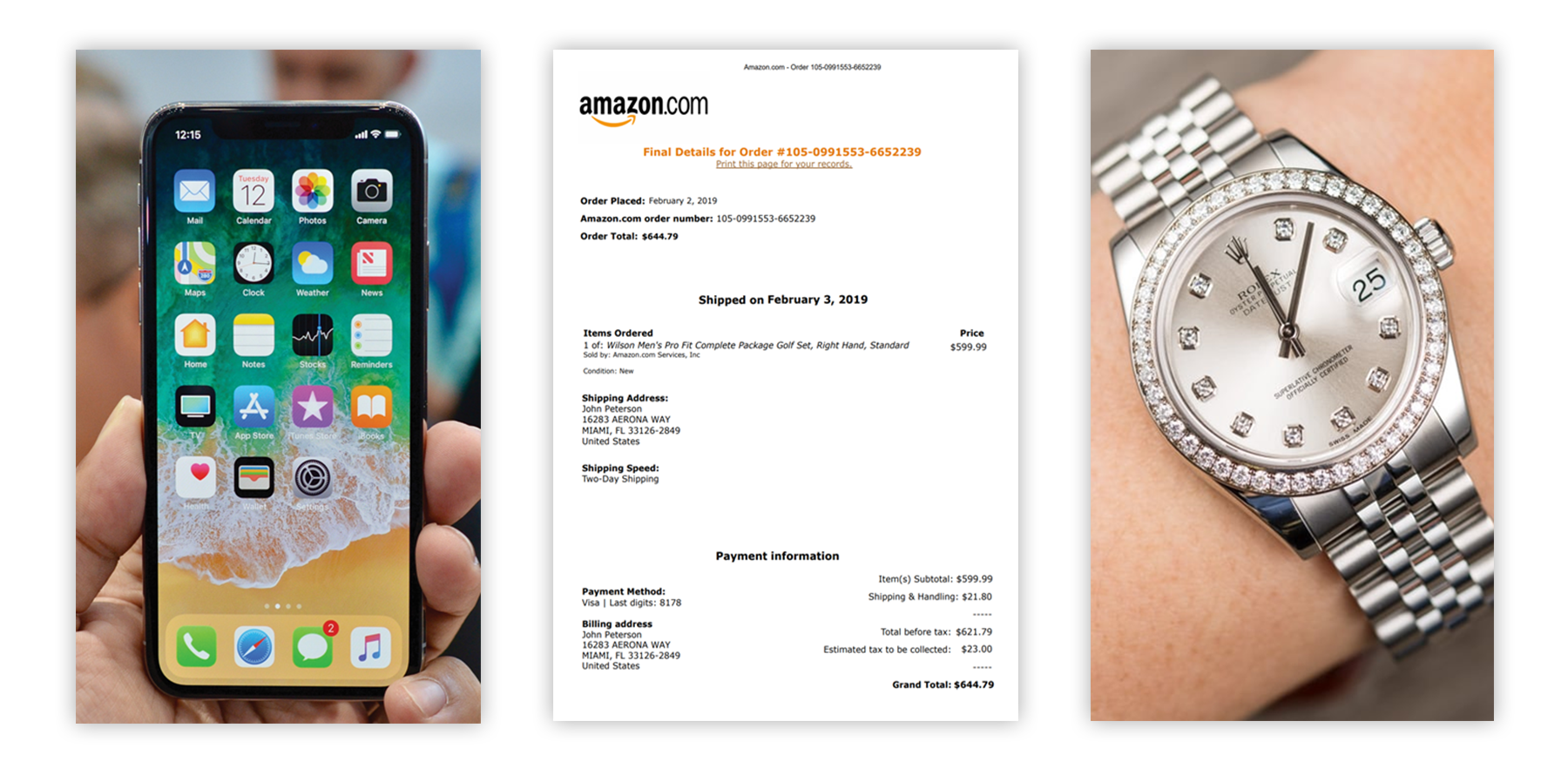

A study conducted by the German insurance association (GDV) concluded that more than half of all claims arising from loss or damage to smartphones or tablet PCs could not have arisen and therefore must have been fraudulent to some extent. As these typically fall below a certain threshold of fraud detection, this means that the fraud findings today are just the tip of the iceberg.

Key Features

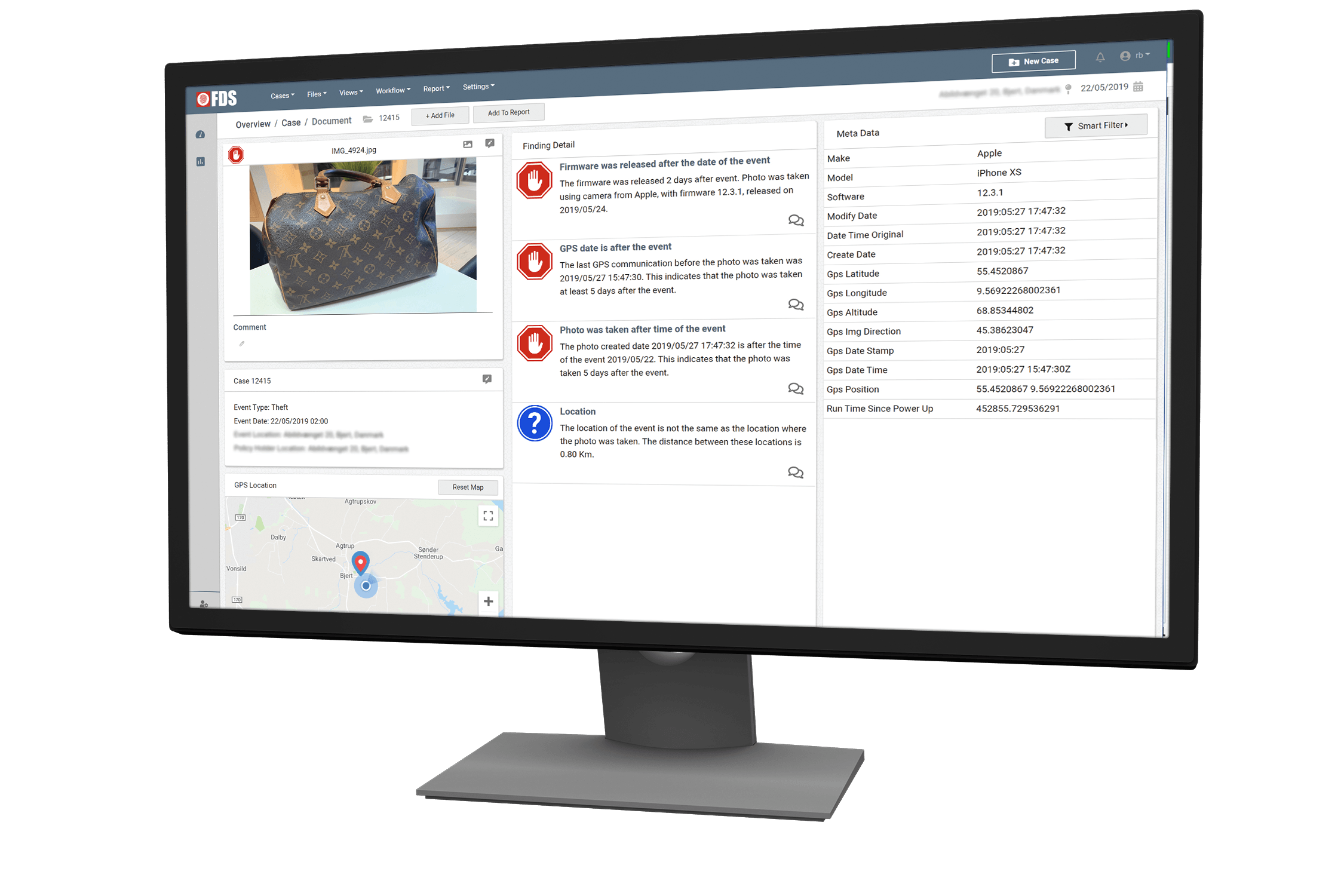

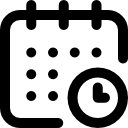

FDS is an on-premise software solution developed to perform forensic authentication, screening and fraud detection on individual claim documents in seconds. FDS examines claim documents, and determine if a file is an unaltered original, an original generated by a specific device, or the result of manipulation through editing software. FDS also determines if a file’s geolocation data aligns with the correspondent claim details. FDS has the capability to evaluate a vast array of file types, including images, invoices, receipts, certificates, health records, employment contracts, warranties and more.

Intelligent Dates Cross-checks

FDS will detect all dates and timings encapsulated in the metadata and verify in accordance with taken-expectations, as well as firmware, GPS dates, ICC-header and profile, runtime since power-up, etc.

Advanced Location Detections

GPS location, satellite communication and GPS within four ranges are verified according to event location or the policyholder’s home address.

Software and Editing Programs

FDS detects if claim documents have been through any suspicious software or editing programs, and can highlight new annotations, fonts and modifications.

PDF Deep Inspection

FDS analyzes PS source code of PDF files and takes all layers apart to detect any manipulation.

FDS DataPoint

The FDS DataPoint will detect if documents have been used before in other claims (internally or externally). The database holds millions of internet documents and “fingerprints” from suspicious on-line invoice services.

Device and Firmware Release

FDS has a database consisting of +60,000 firmware and device release dates, to verify that a device or firmware was released before a claim document was created.

Internet Presence Checker

FDS will detect if a claim document has been downloaded from social media or if the document or a part of the document resides on the web.

E-Learning platform

Full featured e-learning platform with user questionnaires and tests, including certificates to print out when passed.

Improve fraud detection

Deliberate deception perpetrated for the purpose of financial gain, with minimum risk, is a serious challenge for the insurance industry. According to law enforcement agents and analysts, 5-10% of annual claims are fraudulent. Fraud may be committed at different points in the transaction by; applicants, policy holders, third-party claimants or professionals who provide services to claimants. Insurance agents and company employees may also commit insurance fraud. Common frauds include “padding” or inflating claims, misrepresenting facts on claim documents or suggesting incidents that never even occurred, this could include staging incidents.

Schedule an Online Demo and see the potential ROI on fraud findings with FDS.

The patent-pending FDS technology help combat fraudulent policy holders

Document Uniqueness

A revolutionary uniqueness validator, FDS discover DataPoints no matter the file type.

Document Authencity

Utilizing forensic methods to comprise document data within the document itself.

Product Ownership

Get notified in case policyholders return an item they have claimed stolen.

Interrogation Robotics

FDS Claims Robotics ensure a secure STP with real-time STP claim validation with anomaly resolvement.

Lower claims leakage and enhanced operational efficiency

Digital automation is an emerging core component for any insurance company. FDS finds the needle in the haystack and provides you with the evidence, so you only need to spend time on fraudulent claims. This results in much quicker and more cost-effective settlements, as well as increased customer satisfaction. Our team of FDS experts are happy to demonstrate how FDS can improve your claims department.

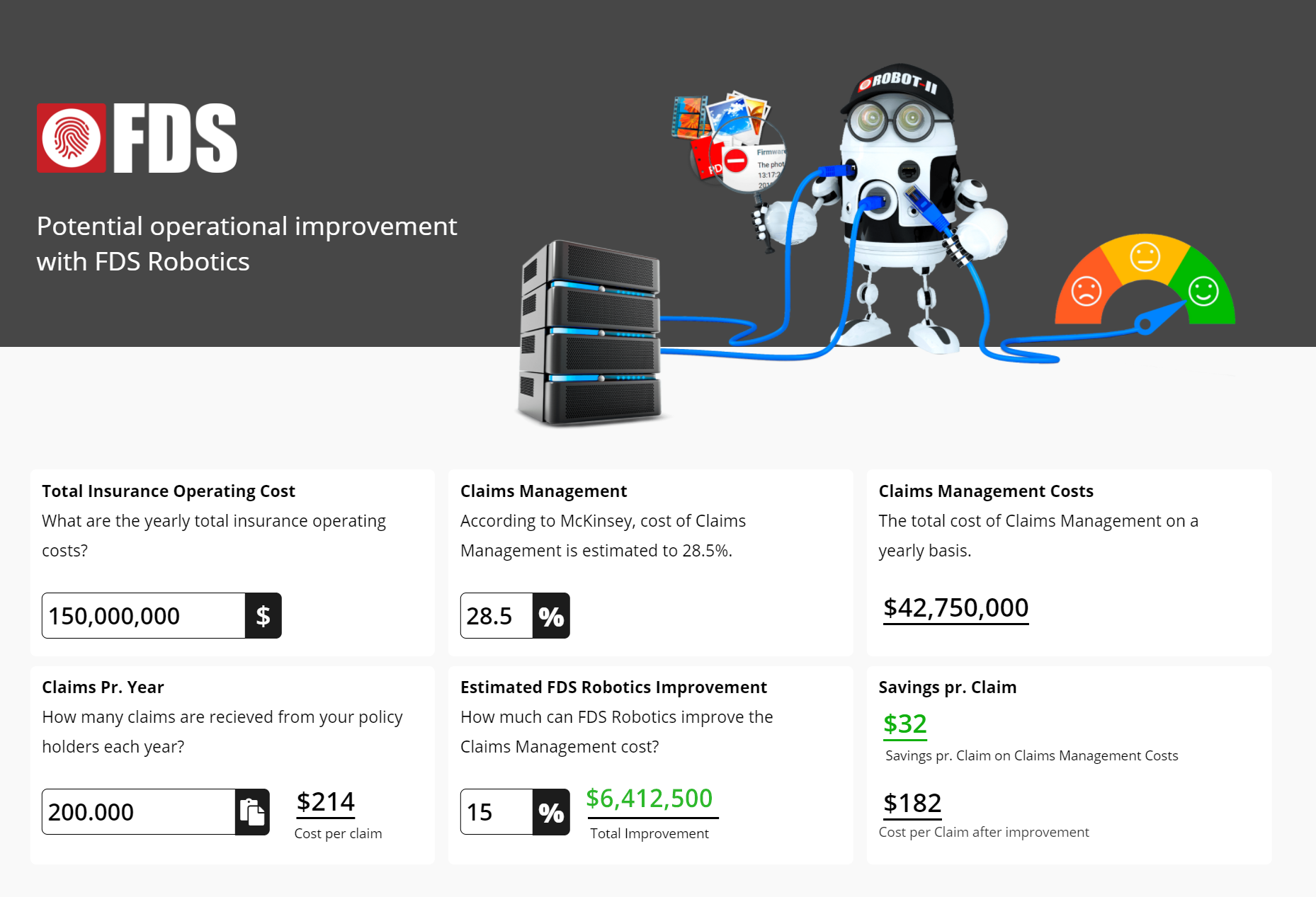

Claims Management accounts (on average) for 28,5% of the operational cost*

Source: McKinsey’s insurance cost benchmarking.

Claims processing is a costly and time-consuming process, with an average of 8 submitted documents per claim, which amounts to millions of documents every year. The majority of documents are perfectly fine and need no further attention, however, in order to find the fraudulent claim documents, all documents need to be looked at, it is like finding the needle in a haystack.

The real waste is time spent on 90-95% of claims where the submitted documents are perfectly fine, which adds up to thousands of wasted manhours every year. To manually validate the validity of a submitted photo or pdf can easily take a claims handler 30-50 seconds per document, even without any digital analysis for fraud. To open a file, make sure the contents correspond with the claim, save and close the file is a very time-consuming manual task.

To stay competitive, insurers need to transform their operating models

The highly regulated insurance industry needs automation to apply superior capability to improve their combined ratio. FDS provides insurers the possibility to deliver better customer service as a result of the quicker claims handling. Today, most volume heavy insurance transactions such as claims processing and document verification are being performed by humans.

FDS automated document verification effectively recognizes and fights fraud at its core, and insurers can free staff to deal with the more complex claims. The claims division is very busy, with a claim backlog needing processing. This is one reason why employees welcome the FDS technology; it relieves them of the rising work pressure and helps them with the increased number of claims documents that need to be carefully examined.

FDS robotics relieves the stress and releases lots of staff hours that can be utilized elsewhere. It’s not just the shareholders, the senior managers, and the policyholders who benefit from FDS, but also employees in claims management. FDS will have a positive impact on productivity.

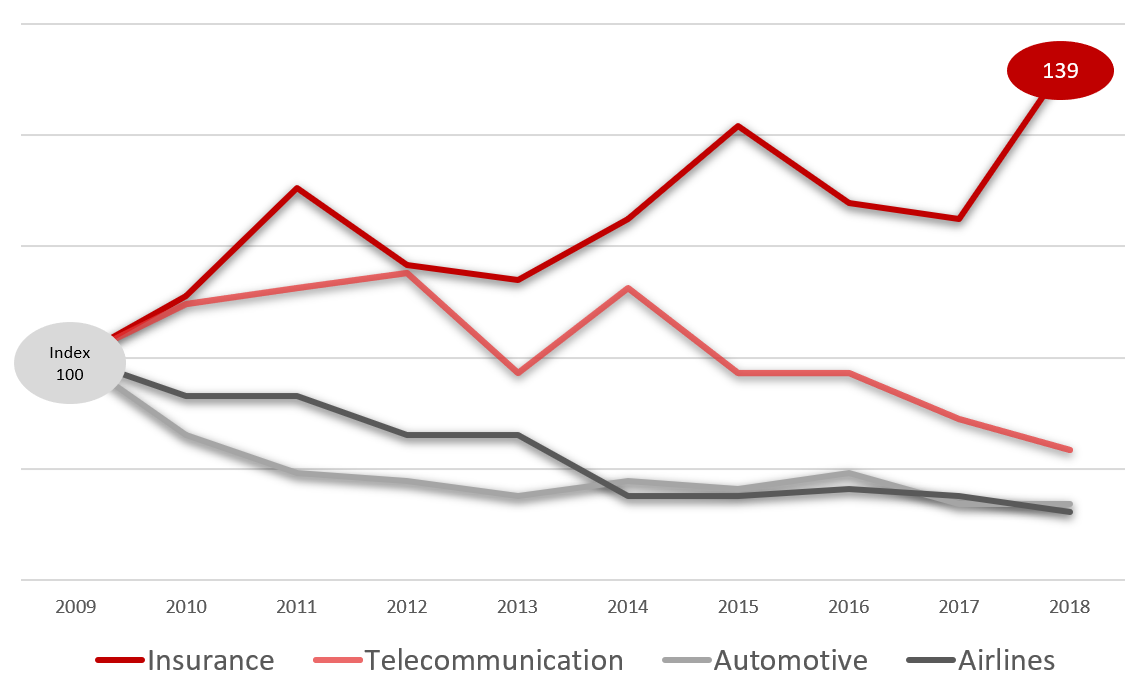

Source: S&P Capital IQ, McKinsey analysis

The productivity imperative in insurance. Most carriers are struggling to meet their cost of capital, and productivity has barely moved over the past decade. Taking a more structural approach to productivity is required to make significant progress.

Building an operational power curve with disruptive technology

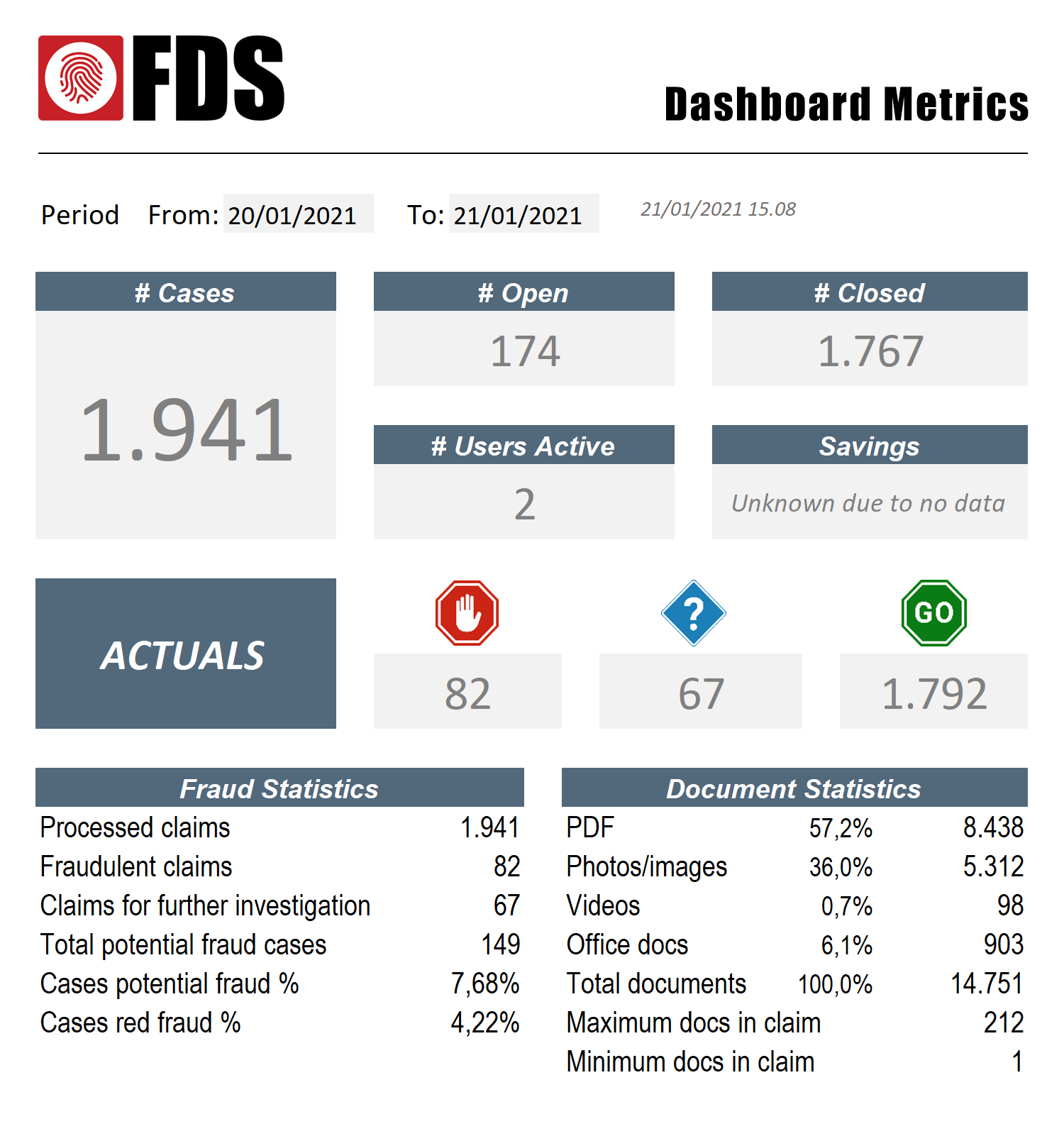

Example of FDS management dashboard with claims data

Insurers are under constant pressure to offer improved services at reduced costs, for claims management in particular. Policy holders embrace digital technologies, and FDS Claim Robotics deliver a strong return on investment (ROI), not only in direct fraud findings, but also by identifying the majority of claims that are legit and therefore does not require any human interaction. FDS advancements simplify insurance processes considerably, and the biggest savings are in the reduced operational cost. FDS envision a smarter future for both insurers and policy holders.

In this example 1,941 claims were processed including 14,751 submitted claim documents. FDS resolved a potential of 149 fraudulent claims (82 fraudulent and 67 need further investigation). More importantly 1,792 claims didn’t raise any alerts and therefore needed no human interaction.

Boosting operational performance with FDS

If a claim handler, in this example, should only verify (not fraud detect) 14,751 documents manually (50 seconds per document) this task would have taken a trained claim handler more than 200-man hours. FDS handles approximately 2 documents per second, which includes the very time-consuming, fraud detection, on claim documents. Furthermore, FDS automatically assigns the red and blue detections to the relevant departments with the findings and all the green detections to the settlement department.

AutoLoad Robot

FDS AutoLoad Robot-I ensures comprehensive document checking on all claims. Use the mailbox integration or load directly via fast and easy-to-setup integration hooks , integrate via exchange of JSON files or utilize the WebAPI.

FDS Claim Robotics

STP is hard to do in a safe manner without a technology to verify submitted claim documents from policy holder, as these documents are critical to justify pay-outs.

FDS WebAPI

The FDS RESTful API is built to ensure that the FDS Detection Engine enables a secure STP environment and integration abilities with any system. Learn much more on a live demonstration.